where's my unemployment tax refund 2020

System to follow the status of your refund. As of late April.

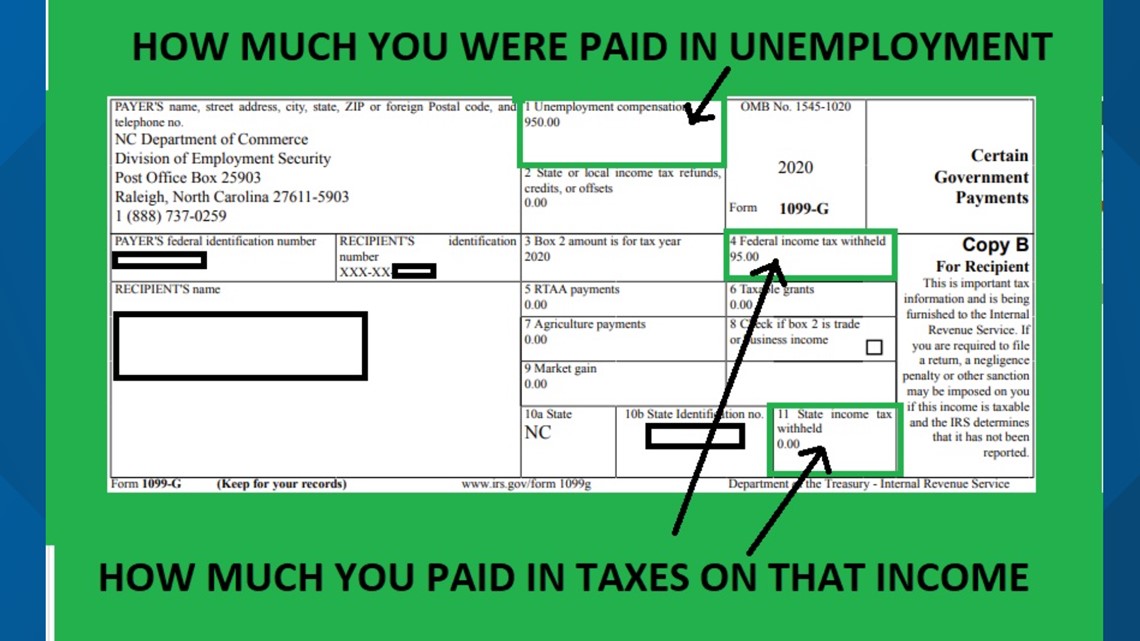

Unemployment Benefits Are Taxable Look For A 1099 G Form Wfmynews2 Com

The new IRS look-up tool called IRS Wheres My Amended Return can be used approximately 3 weeks after the amended tax return has been mailed to.

. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. Amended tax and wage report PDF 138K. Some refunds that are requested as Direct Deposit may be converted to paper check and mailed to the taxpayers address as a method of verifying that the refund is legitimate.

Direct Deposit Limits We only deposit up to five Minnesota income tax refunds and five property tax refunds into a. Those who filed 2020 tax returns before Congress passed an exclusion on the first 10200 in unemployment. Confirm that the IRS.

Your tax return will be processed with the updated requirements. We have a sister site for all Unemployment questions. Visit Wait times to.

The tax agency says it recently sent. The IRS has sent 87 million unemployment compensation refunds so far. The link is in the Group Announcements.

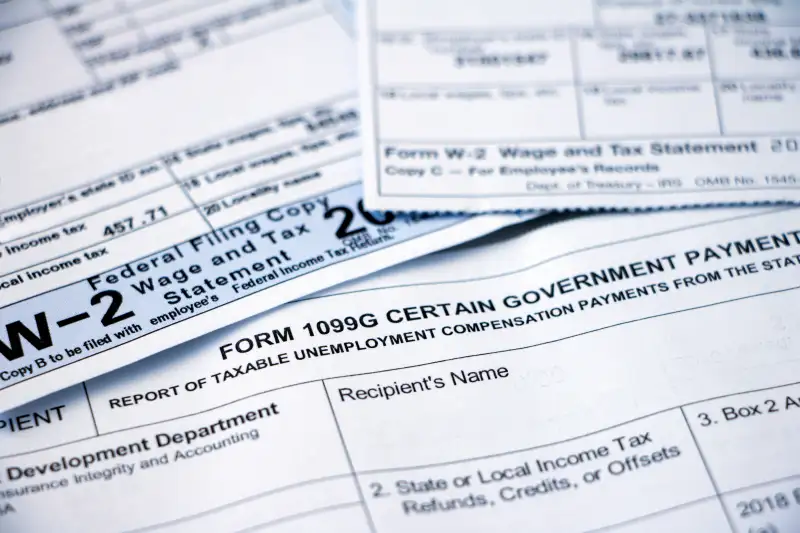

Refunds set to start in May. The IRS says eligible individuals shouldve received Form 1099-G from their state unemployment agency showing in. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

Most recent status updated Sept 16 2022 IRS says. You donât need to do anything. Unemployment 10200 tax break.

This threshold applies to all filing statuses and it doesnt double to. The 2021 tax year might rapidly be drawing to a close but the Internal Revenue Service is still busy issuing refunds to people for 2020. State law instructs ESD to adjust the flat social tax rate based on the employers rate class.

The flat social tax is capped at 050 for 2021 050 for 2022 075 for 2023 085 for 2024 and. Check The Refund Status Through Your Online Tax Account. Payment coupon PDF 30KB.

IRS continues to review tax year 2020 returns and process corrections for taxpayers who paid taxes on unemployment compensation to. Unemployment taxes forms and publications Unemployment tax payment and refund forms. To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000.

Use our Wheres My Refund. A page for taxpayers to share information and news about delays IRS phone numbers etc. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189.

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com

Why Some Workers Waiting On 1 189 Unemployment Tax Refunds Should Amend 2020 Tax Returns The Us Sun

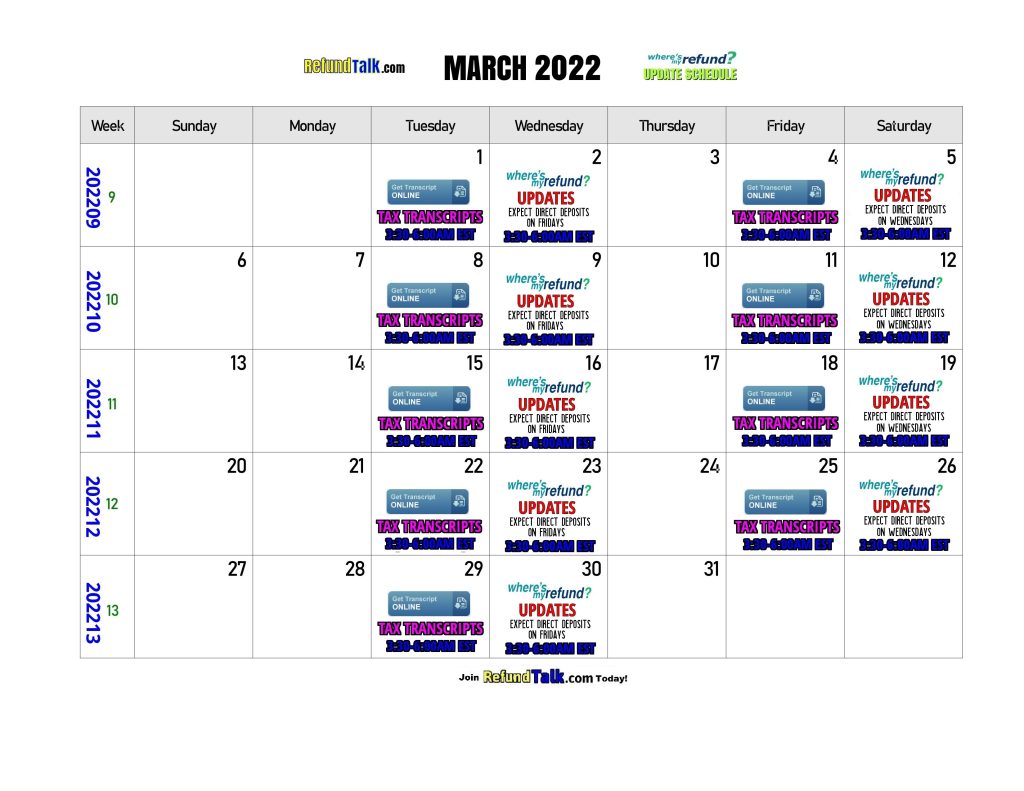

Tax Refund Updates Calendar Where S My Refund Tax News Information

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Filing Your Taxes If You Claimed Unemployment Benefits What To Know Where To Find Help Kqed

Irs Backlogs Causing Massive Delays In Processing Returns

Where S My Refund 2020 2021 Tax Refund Stimulus Updates What Do I Suppose To Be Looking At For The Unemployment Tax Refund Facebook

Just Got My Unemployment Tax Refund R Irs

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Irs Unemployment Refund Status Has My Payment Been Held

When Can You File Taxes Where Is My Tax Refund Check Money

Irs Unemployment Refund Update How To Track And Check Its State As Usa

Irs Unemployment Tax Refund How To Track The Status Of Your Tax Refund Online Youtube

I Got Unemployment In Florida How Will My Taxes Be Affected Firstcoastnews Com

Your Unemployment Tax Refund Is Coming In May Irs Says Here S How To Get Yours Nj Com

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System The Us Sun

H R Block Turbotax Help Filers Claim 10 200 Unemployment Tax Break

Report Unemployment Benefits Income On Your Tax Return

How To Get A Refund For Taxes On Unemployment Benefits Solid State